Here's a simplified overview of the process and considerations when purchasing repossessed or foreclosed properties in Navi Mumbai, along with the role of CIDCO and the necessary documentation.

Overview of Buying Repossessed Properties

Purchasing repossessed or foreclosed properties can be enticing due to discounts of 30-40% off market rates. However, buyers must be cautious as these properties often have significant legal issues, including:

- Lack of proper building permissions

- Missing specific permissions required in Navi Mumbai

CIDCO's Role in Navi Mumbai

Navi Mumbai was developed in the 1970s by CIDCO (City and Industrial Development Corporation), which serves as the planning authority. Key points about CIDCO's involvement include:Land Acquisition: Villagers were compensated under the land acquisition act and given land for personal sale or development.

Gaothan Expansion Scheme: This scheme allowed for construction under the Sade Barah Takka (12.5%) rule.

Regulatory Framework: CIDCO established rules under the Navi Mumbai Disposal of Lands Act and Navi Mumbai Disposal of Land Rules, which govern the sale of properties that have defaulted on bank loans.

Documents Required for Purchase

Before purchasing a flat, shop, or land, ensure the following documents are in order:

- Building Permissions: Obtain from CIDCO/NMMC (Completion Certificate, Occupancy Certificate, Sanctioned Plans).

- Society Formation Documents: Ensure the society is registered.

- CIDCO Conveyance Documents: Verify the society's conveyance documents.

- Approved Member List: Get the CIDCO-approved list of society members.

- Final Order from CIDCO: Ensure there is a final order in favor of the society.

- Mortgage NOC: Obtain a No Objection Certificate from CIDCO for the defaulting owner.

- NOC from Society: Required for the bank to repossess and sell the flat.

- Court Order: A District Magistrate Court order for foreclosure under the SARFAESI Act.

- Auction NOC: NOC from CIDCO for selling the flats via auction (to be obtained by the bank).

Once these documents are secured, you can participate in the bank's online auction.

Post-Auction Process

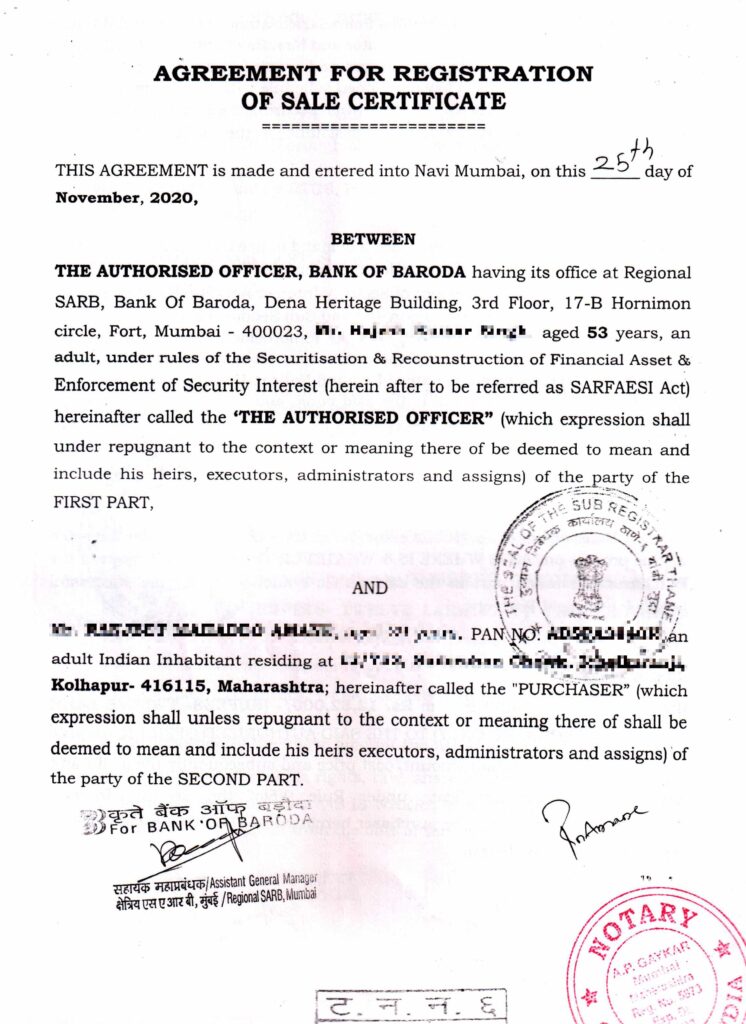

- Winning the Bid: After winning, the bank issues a Certificate of Sale, confirming your bid and payment.

- Registration: This certificate must be registered along with a sale agreement at the Revenue Department. You will need to pay Stamp Duty based on the auction price or the Ready Reckoner Rate (whichever is higher) and registration charges.

- CIDCO NOC: After registration, approach CIDCO with all documents to obtain the necessary NOC for the sale. If payment is made in full, CIDCO will issue a final order directly. If a loan is involved, you must obtain a CIDCO NOC for the loan and then apply for the final order after the loan disbursal.

Recent Legal Developments

A recent ruling by the High Court declared that ‘as-is-where-is’ clauses used by banks in property auctions are illegal. This means that if there are any pre-existing legal title issues, the bank cannot avoid responsibility based on this clause. In a notable case, PNB Bank had to refund the entire amount to a buyer due to this ruling.

If you have any further questions or need clarification on any specific points, feel free to ask! 😊

Copies of all documents are given below for reference.

|

| Certificate of Sale (Bank Auction Properties) |

|

| Agreement for registration of certificate of sale |

District Magistrate order Download .

Sky Properties, Nerul, Navi Mumbai

Address A-1, 7,2, Sneh Co Op Society,

Plot no 16, Sector 19a,

Nerul, Navi Mumbai 400706

Call Us 9987452642

mayur@navimumbaiestate.in