Arihant Anaya Original Members List (Kharghar)

Members of Arihant Anaya, Kharghar, as listed in Conveyance Deed With CIDCO

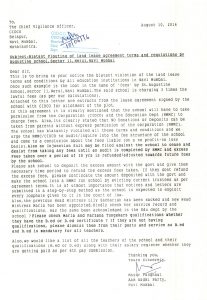

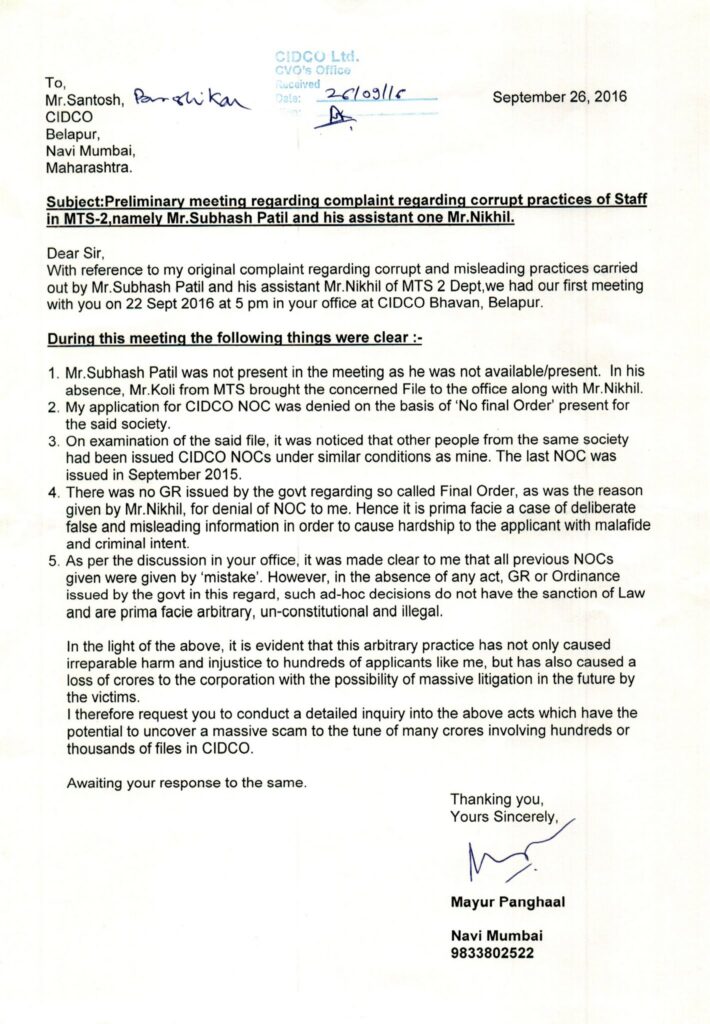

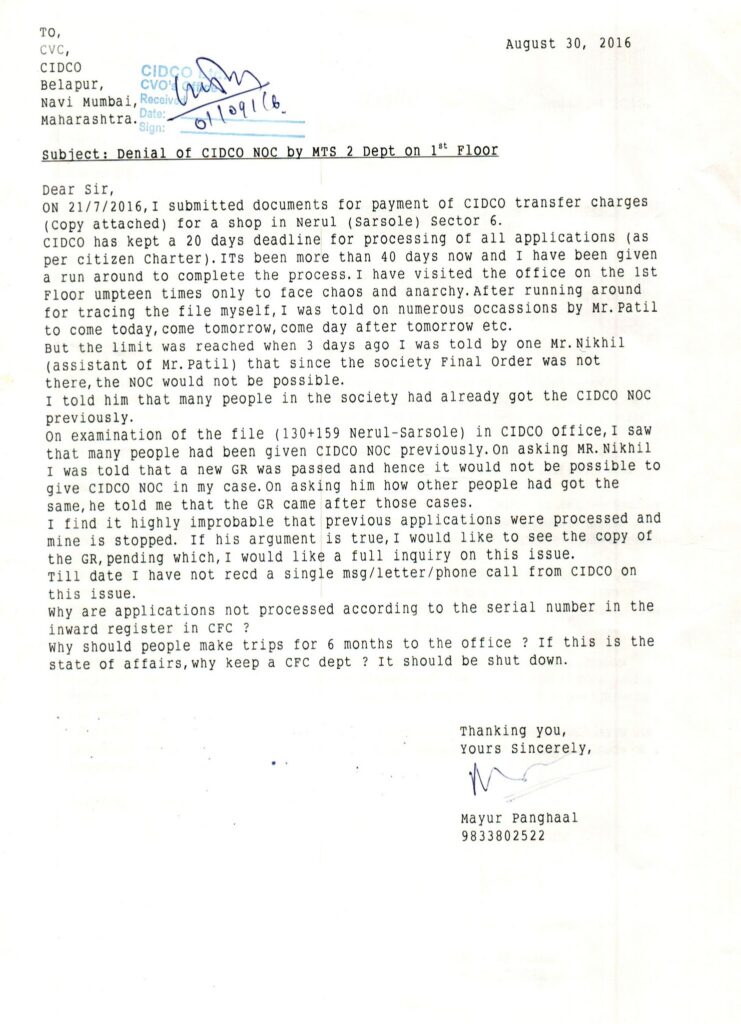

How to nail corrupt officers in CIDCO Transfer Dept

Whenever an application is submitted in CIDCO for transfer, it is allotted a CFC Number (Serial Number). According to Anti-Corruption laws, even if a govt officer gives out of turn facility (Preferential treatment) to someone or favors someone for quicker processing of files out of turn and not according to the serial number (Provided there is no objection or issue raised with the file or application) it is considered as CORRUPTION.

It is due to this very reason that CIDCO does not display the list of applicants on its website along with their CFC Numbers, even though this is public information as per RTI act. CIDCO knows that the day they start displaying the list of applicants along with their serial numbers online, they will be forced to process applications as per serial number and all their bribery will be exposed.

Remember : As per rules, CIDCO is supposed to issue you a Transfer NOC within 21 days and Mortgage NOC within 7 days.

So if you are being made to run around by CIDCO officers since you are not paying them a bribe and you are 100% sure about your documents being in order, you can complain about out of turn favors to anyone who submitted his documents after you but got his CIDCO NOC before you.

If you know for sure that somebody who submitted his application after yours but got his NOC before you, its considered as CORRUPTION under the Prevention of Corruption Act.

You can also file an online RTI asking for the serial numbers of Applications submitted to CIDCO for any particular month and their clearance date. This will give you an accurate picture of whose application got cleared out of turn. You can file an online RTI from the comfort of your home here

|

|

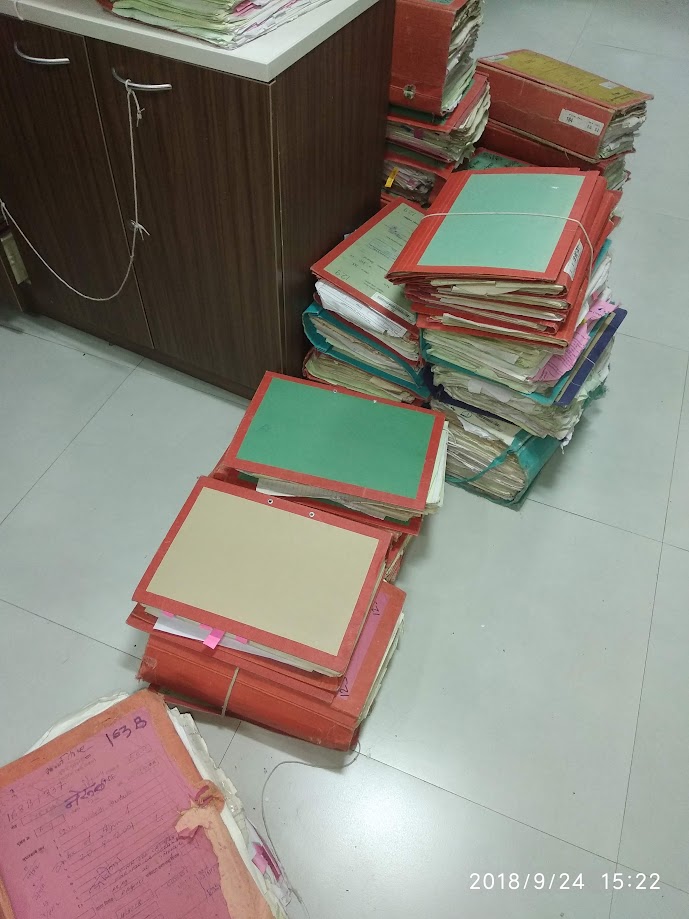

Every plot number and society has a file which contains all details about every member and every flat.

If the number after your number (or two) shows that the NOC has been issued, you have your evidence needed for the complaint. They will have to investigate the movement of your application from the time it was submitted. Every movement of every file at every step in CIDCO is recorded in the File movement Register (peon register) and it is very difficult (impossible) to destroy this record.

Almost every CIDCO officer will be caught for corruption if this method is deployed by any citizen.

You can also complain online using the same logic at this link If you do not have an account you can created one by clicking on the Register New link. Once you make your complaint, you can also track it online.

Corruption in CIDCO Transfer Dept

The corruption is so blatant that its running under the very nose of the so called \’Vigilance Dept\’ located on the 6th floor of the same building !!

Any complaint to the officers is simply brushed aside or the complainant is made to do so much running around that he is forced to give up. The level of corruption going on in CIDCO has also led to murders of staff in the past.

Even the harmless looking women sitting behind counters on the first floor in the estate department are corrupt to the core.

Looks can be really deceptive. All are heavily involved in taking money and bribes to process your files. In such a situation it can be easily said that CIDCO is one of the most corrupt organizations in the country.

In a new move, CIDCO has started charging 18% GST on All NOCs … which means every transfer/NOC will now cost thousands of rupees more This Circular was issued on 5th December 2017…and will also be sent to all who were issued NOCs after July 2017For issuing Mortgage NOC, CIDCO charges Rs 500+18% GST as processing fees

Although it cannot be assured that your complain online will be acted upon. Always file a written complaint and take an acknowledgement from the Vigilance Dept on the xerox along with the date and time. Even though the Vigilance Dept itself is a big question mark, its worth giving a shot.

If you are worried about complaining while your file is under process, you can also complain once you get your CIDCO NOC in hand.

| Services Offered by us | |

|---|---|

| CIDCO Transfer only | 15,000 |

| Mortgage NOC only | 15,000 |

| CIDCO Transfer + Mortgage NOC | 20,000 |

| Only Drafting/Documentation | 5,000 |

| Drafting and Registration of Sale Agreement/Sale Deed | 10,000 |

| Brokerage (Purchase/Sale transaction) | 2% |

| Brokerage (Rentals) | 1 month rent/year |

| Consultation over Phone/Whatsapp/Zoom/Google Meet | 5,000/30 mins |

| Property Tax Name Transfer | 10,000 |

| Water Bill Name Transfer | 10,000 |

CIDCO’s amnesty scheme for POA owners of its flats

CIDCO has sold flats based on a strict condition that before selling the CIDCO flats, owners will have to take permission from CIDCO and they will have to share 50% of the profit (difference between their selling price and the price at which they purchased from CIDCO) from sale with CIDCO. This gave rise to various tactics to evade these additional charges.

For example, a flat in E type apartments (3 bhk @ 1000 sq ft carpet area) which was purchased at Rs 30,000 in 1973 started fetching a price of Rs 3,00,000 in 1980,which meant that 1.5 lakhs would have to be paid to CIDCO as profit share in case the flat owner wanted to sell the flat.

Most people started selling their flat on POA (Power of Attorney), thereby depriving CIDCO and the State of massive funds.

This POA later gave rise to various other issues, due to which owners couldn’t sell their flats, couldn’t become society members, couldn’t obtain loans etc.

The Scheme

In 2011, the Govt announced an amnesty scheme wherein the defaulters could pay the set fees and penalty as a one time charge to regularize their flats in these buildings…however this was applicable only to flats purchased before June 2009 and the whereabouts of the seller (original owner) was not known (traceable).

Current Status (Legal Issues)

The scheme has currently been suspended as it involves legal issues which need to be sorted out at the Level of the Law governing all sales and purchases of flats. Giving Amnesty for all such purchases will give rise to further complications in the future. Power of attorney is only valid till the lifetime of the person who is giving it. There is no guarantee that the person who gave the Power of attorney is still alive. In that case, the transaction will become completely illegal as the Power of Attorney is invalid anyways after a person dies.

Current laws make it compulsory for the Power of Attorney regarding Flat or property purchase to be registered.

The registrar can ask for people who are parties to the old Power to Attorney to come and register the agreement but the law says that the executed (signed) agreement has to be registered within 4 months of the signature.

Also the CIDCO sale agreement specifies clearly that only direct blood relatives of the buyer can be appointed as Power of Attorney Holders.

That presents a whole new problem. The present law will have to be amended before this scheme can be implemented. But this is highly unlikely as it will give rise to unimaginable consequences legally.

Political schemes to fool people before elections

Most people are unaware that the country is governed with laws.

Laws are passed in Assembly for matters which come under state list in the constitution.

The law comes into force when it is approved by both houses and is signed by the governor and published in the Gazette.

It is for this reason that another name for politicians is LAWMAKERS. But most fool people by promising to do \’Seva\’ of people. What exactly this SEVA is … is not defined or mentioned anywhere in the constitution.

Politicians in connivance with chor bureaucrats are expert at concocting such nonsense and illegal schemes and getting it published in the papers to fool people.

They know that people wont know the truth anyways.

Fool them and take votes. To hell with what happens later.

This is the fate of the country. Where the current lot would not know abc of the law and give votes based on \’promises\’ and lies. They don\’t even know that the only job and legal duty of the politician is to make laws in the assembly and parliament. After the law is made, they can\’t even change a full stop or comma in the law.

Charges for our Services

| CIDCO Transfer only | 15,000 |

| Mortgage NOC only | 15,000 |

| CIDCO Transfer + Mortgage NOC | 20,000 |

| Only Drafting/Documentation | 5,000 |

| Drafting and Registration of Sale Agreement/Sale Deed | 10,000 |

| Brokerage (Purchase/Sale transaction) | 2% |

| Brokerage (Rentals) | 1 month rent/year |

| Consultation over Phone/Whatsapp/Zoom/Google Meet | 4,000/30 mins |

| Property Tax Name Transfer | 10,000 |

| Water Bill Name Transfer | 10,000 |

Stamp Duty Rates increase in Kharghar, Kamothe, Kalamboli, and New Panvel

Since September 2016, Panvel Municipal Council has become a Municipal Corporation, encompassing more than 29 villages and areas. However, Mumbai is exempt from the 1% Local Body Tax (LBT), while Nagpur has a LBT of 6.5%. In addition, the Stamp Duty rate for property transactions within the Panvel Municipal Corporation has increased from 5% to 6%.

Stamp Duty for Ulwe is also 6%

The following areas will now have to pay a higher Stamp Duty rate of 6%: Kharghar, Taloja Panchnand, Kalundre, Owe, Kamothe, Chal, Navde, Devicha pada, Tondhare, Pendhar, Kalamboli, Khidukpada, Roadpali, Padghe, Walvli, Pale Khurd, Tembhode, Asudgaon, Bid, Adivali, Rohinjan, Dhansar, Karvale Budruk, Pisarve, Turbhe, Nagzari, Taloje Majkur, Ghot, and Koynavele.

Points to note while paying Stamp Duty

Stamp Paper Validity

In Maharashtra, stamp paper is valid for 6 months from the date of purchase. This means that any agreement written on the stamp paper must be signed by all parties within 6 months. After signing, you have an additional 4 months to register the agreement.

Stamp paper registration time limit

Stamp paper with signatures of all people required is supposed to be registered within 4 months from date of the signatures. If there is delay, penalty of 10 times the registration fees can be charged by the Registrar.

Part registration

If not everyone can be present on the same day, the registration can be done with just one person who is signing the agreement. Then, the others can come within 4 months to re-register the document.

Stamp Duty Rounding off

When the Stamp Duty amount payable is Rs 10,049, it will be rounded down to Rs 10,000. If the Stamp Duty amount payable is Rs 10,051, it will be rounded up to Rs 10,100.

Stamp Duty and Registration Charge on Sale Deed (after sale agreement)

Registration and Stamp Duty charge for Sale Deed (not sale agreement) is Rs 100 only and can be paid at the Registration office itself on the day of Registration. Stamp Paper of Rs 100 can be used for the same.

Stamp duty and Registration on Lease of Agricultural Land in Maharashtra

To calculate the Stamp Duty on the lease of agricultural land, you can follow these steps:

- Determine the market value (Ready Reckoner Value of the land).

- Divide the Ready Reckoner value by 10.

- Multiply the result with the number of Gunthas.

- This should give you the Market Value of the Land to be leased.

Note: Current Market value of Land in villages surrounding Navi Mumbai Municipal areas is approx Rs 4.5 lakh rupees per Guntha (100 sq meters)

- This should give you the Market Value of the Land to be leased.

- Deduct 10% from the total market value.

- 5% of this amount will be your Stamp Duty.

- Additionally, there is a registration fee of 1%, up to a maximum of Rs 30,000, that is applicable regardless of the Market Value Amount.

Depreciation (घसारा) on Stamp Duty : How to calculate Depreciation ?

When it comes to selling property, there is a possibility of getting a depreciation ranging from 10% to 70% on the Ready Reckoner value of the property. However, there\’s a catch. The Ready Reckoner value needs to be calculated and then the depreciation percentage has to be subtracted from it. This resulting value is compared to the actual price of the property mentioned in the sale agreement. The higher value between the two is used to calculate the stamp duty and registration fees. In reality, it is unlikely that the agreement value will be lower or equal to the Ready Reckoner value, so the potential benefit of depreciation may not be substantial.

Method to Calculate the Depreciation of Row Houses :

Sale Price Mentioned in the agreement

– (minus/subtract) The Ready Reckoner Price of the Plot of land on which the Row House Stands

– (minus/Subtract) 30%

+ (Add) Ready Reckoner Price of the Plot of Land.

Other than this, CIDCO Transfer (NOC) charges are to be paid to CIDCO if the property/land/flat or any real estate is being purchased in areas managed by CIDCO (From Airoli to Panvel).

For more information on CIDCO transfer charges click this link

Sky Properties, Nerul, Navi Mumbai

Address A-1, 7,2, Sneh Co Op Society, Plot no 16, Sector 19a, Nerul, Navi Mumbai 400706

Call Us 9987452642

mayur@navimumbaiestate.in

-

Here's a detailed overview of CIDCO Transfer Charges in Navi Mumbai, including their significance, the issues of corruption, and the nec...

-

Whenever one decides to purchase a plot of village land (agricultural land) in Maharashtra, he is shown the map of the plot of land with all...

-

Is CIDCO Transfer no longer required now ? Are CIDCO charges really cancelled now ? Unfortunately, the short answer to that is : CIDCO ARE S...

Palm Beach Residency by Wadhwa-Scam Made in heaven

Palm Beach Residency, Nerul, Navi Mumbai A Brief history of the Palm Beach Residency Project by Wadhwa on Palm Beach Road, Nerul, Navi Mumba...